Bakara-chan

Bakara-chanThis article summarizes information about tax returns at online casinos.

Especially if you are new to online casinos or if you are a winning user, you may want to take a look.

I'll write it as clearly and concisely as possible, so put it in the corner of your head.

About online casino tax returns

Income classification

Bakara-chan

Bakara-chanFirst of all, income from online casinos is classified as temporary income.

It's the same as refunds for horse racing (when there is no actual business).

For the time being, the profit (winning money) of the online casino will be taxed.

Since it is a one-time income, if it is 20 or less, you do not need to file a tax return.

If the annual amount is 50 yen or less, the special deduction of 50 yen can be deducted, so no tax will be charged. (If there is no other temporary income)

How to calculate the cost of making a profit at an online casino

Bakara-chan

Bakara-chanYou have to know this, but you can only count it as an expense, that is, the amount you spend, "only when you make a profit."

This is something I really want you to be aware of.

I can't calculate with simple net profit, so please refer to the following.

As a calculation formula"Total dividends (winning money) from January to December"-"Expenditure (bet amount when dividends are paid)"-"1 (special deduction)" = "Amount of temporary income".

AndTemporary income taxable = "Temporary income" * "1/2".

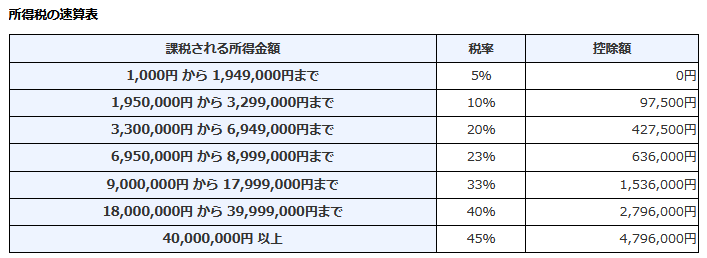

つ ま りThe amount of income tax is "taxable amount" * "tax rate (if 10% or more, deduction amount is deducted)" * "1.021" = income tax amount.

An example

・ Bet 100 million yen and pay 200 million dividends (net profit 100 million)

・ Bet 100 million yen and pay 300 million dividends (net profit 200 million)

・ Bet 100 million yen and pay no dividend (loss of 100 million yen)

If you play 3 games like that, your net profit will be 200 million yen.

In this case, 500 million is pushed against the dividend of 300 million, so I would like to think that 300 million can be counted as expenditure, but unfortunately only the bet of 200 million yen for which the dividend was generated can be counted as expenditure.

つ ま り"500 million (dividend)"-(200 million (expenditure))-"50 (special deduction)" = "250 million (temporary income)"Therefore, 250 million yen becomes temporary income and half of this amount, that is, 1 million yen is taxable.

So in this case"125 million (taxable)" * "5% (tax rate)" * "1.021" = "63,812 yen"Is a tax that must be paid.

General user

General userIs the amount simply lost a no count?

Bakara-chan

Bakara-chanExtreme story, "net profit"-"50" = "taxable amount"

"Taxable amount" * "Tax rate" ("-Deduction amount") * "1.021" = "Income tax amount", isn't it?

For example, if the net profit is 500 million, "500 million (net profit) -50 (deduction)" = "450 million (taxable amount) * 0.2 (tax rate) -427,500 yen (deduction amount) * 1.021" = "482,422 yen" (I have to pay it) ".

In other words, in some cases, even if the total balance is negative, taxes may be incurred, so you should calculate it properly.

Saito

SaitoPeople who are losing are good, but if they are winning and have their main business or other income, residence tax will also be involved, so people who do not want to get caught in the company do not do matters related to residence tax on their own I can't do it.

What if I don't pay the tax?Are you sure?Isn't it out?What are the measures?

Saito

SaitoSpeaking only of the upper side, if you do not pay the tax even though you are obliged to pay it, you will be tax evaded, so if you get caught, you may end up with additional taxation or the worst criminal accusation as a penalty.

However, as a realistic story, I think it's true that there are many people who haven't been able to win because they haven't been able to win in the first place.

Not many people bother to win horse races and pachinko (excluding online purchases), but in this regard, the current situation is that there is no data on deposits and withdrawals, so there is no way to grasp it. ..

Bakara-chan

Bakara-chanAt online casinos, deposits and withdrawals are recorded when you go through a bank transfer ... I think it's bad if you don't do it properly.

Saito

SaitoThat's right.I don't think you'll be suddenly charged with criminal charges unless you're in the hundreds of millions.As for that amount, it may be left unattended because it is at the discretion of the national tax, or it may just be allowed to swim, so if you have an obligation, you should pay the tax properly.

Bakara-chan

Bakara-chanThis is because if you use bank transfer as a result of Ecopaise or Venus Point, it will be recorded as a deposit / withdrawal record, but what about Bitcoin or virtual currency?

Saito

SaitoIn the case of virtual currency, the record remains, but it is different from the deposit and withdrawal record because it is a record that you moved from this address to this address.

For example, if you buy 10 yen worth of Bitcoin at an exchange, send it to a casino, double it, return to the exchange, sell it, make it 20 and deposit it in your bank account, it will remain as a complete record. circle.In this case, it may be the profit of virtual currency (comprehensive taxation on miscellaneous income).

However, as a result, if the bank account is not credited as legal tender, it will not be connected to personal information.In other words, it can be said that it is difficult to follow as a record.

It's up to you to see what you think of this.

Well, if you win stupidly, you should consult with an accountant you know.

If "Deposit 10 Ecopaise etc. from bank account → Deposit to casino → 20 withdrawal from casino (10 profit) → 20 deposit to Ecopaise etc. → 20 deposit to bank account", 10 profit is generated It can be said that it is a temporary income because you can see.

"Deposit 10 yen from a bank account to a virtual currency exchange, etc. → Purchase 10 yen worth of virtual currency at the exchange → Deposit 10 yen worth of virtual currency to the casino → 20 yen worth from the casino (10 profit) Withdraw the virtual currency to the exchange → Sell the virtual currency at the virtual currency exchange and withdraw 20 yen to your bank account (10 profit) ”can be said to be the profit of the virtual currency transaction.

"Deposit 10 yen from a bank account to a virtual currency exchange, etc. → Purchase 10 yen worth of virtual currency at the exchange → Deposit 10 yen worth of virtual currency to the casino → Deposit to a debit card that can charge virtual currency from the casino If you buy 20 yen worth of money, sell it at a pawn shop, etc. and get 18 yen, you can say that it is similar to the pachinko cashing system.

Saito

SaitoThere is no tax on the purchase of virtual currency, and the timing of taxation is when you make a profit and change to legal tender.

Even if you buy 10 yen worth of Bitcoin and use it to increase it to 1000 million yen worth of Bitcoin, you will not be charged tax unless you cash it (profit).

Therefore, if there are no transactions that are profitable on the exchange or bank as a result, it will not be possible to record deposits and withdrawals.

That may be the reason why virtual currencies can be used at online casinos.

Rureko

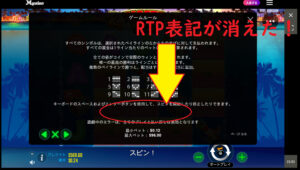

RurekoBy the way, in the game play history of online casinos (although there are some places where it does not remain firmly), such player information is rarely disclosed to third parties at casinos that are legally operated overseas.

General user

General userHey!Japanese users may be tax evading!Please provide user information!

General user

General userIt's impossible.There is a duty of confidentiality.It's not under the jurisdiction of Japan and has nothing to do with the law.

Bakara-chan

Bakara-chanI wonder if it will be like that ...

Summary

Saito

SaitoFirst of all, I think it's more important to make a profit than this kind of knowledge.

It's a story that you should investigate and pay the tax when you make a profit and what the tax is.

Since the number of casinos where you can play anonymously only with deposits and withdrawals in virtual currency is increasing, it may be good to register in anticipation of the future.

The following articles may be helpful.

Comment